The Jones Act Market is characterized by its high barriers to entry in terms of capital requirements, citizenship qualifications, high operational costs and related concerns, etc. As such, the majority of the market has been mostly focused on the inland, the offshore trade in the US Gulf (read oil drilling and offshore platforms), the coastal trade of petroleum products and chemicals from the US Gulf Coast to Florida, along the Atlantic Coast / East Coast, and to the West Coast via the Panama Canal. There is of course the crude oil trade from Alaska’s North Slope to the West Coast of the USA, run by the Alaska Tanker Company (ATC.)

Last time the Jones Act tanker market made front-page news was when ExxonMobil ordered in 2011 two 115,000 dwt aframax tankers at Aker Philadelphia at the announced price of US$ 200 million each. It has been reported that the vessels are ‘full redundancy’ specification with two (fuel efficient) engines, two propellers and two rudders, and of course equipped to the latest standards of technology and navigation; the transaction had ma news for the high construction cost of the vessels, when mainstream tankers from top-quality foreign shipbuilders could be had at the time at US$ 50 million per vessel; for ExxonMobil’s high standards for vessels trading in the particularly sensitive Prince Williams to California route, we surmise the cost to had been below US$ 100 million per copy from high quality international builders.

The previous time in recent memory the Jones Act tanker market had been in the news was in 2006, when the now troubled Overseas Shipholding Group (OSG) contracted in 2006 to take on bareboat charter ten product tankers built at Aker Philadelphia, to crew and manage them and to offer them on timecharter to strategic clients like refineries, traders, and oil companies. The transaction was newsworthy for its size (ten-tanker-newbuilding order is a wave-making deal in the Jones Act market; also, the total cost of the transaction was newsworthy as well at about US$ 930 million.)

However, ever since the introduction of hydraulic fracturing technology (‘fracking’) and the discoveries of huge deposits of shale oil in the US in the last four years, the Jones Act tanker market has been a major beneficiary of the structural changes for the crude oil and petroleum products trade. The market was caught off-guard and undersupplied, with reports that at least in one instance, a Jones Act product tanker trading crude oil managed to get a one-year fixture at US$ 100,000 per diem by a major oil company.

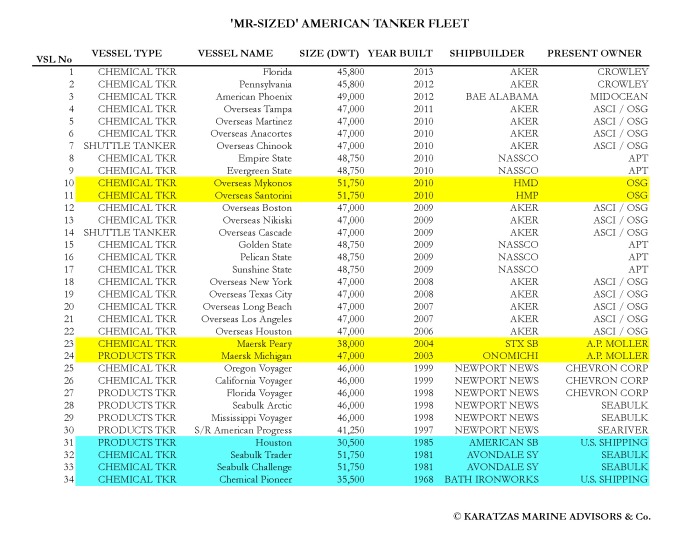

According to data tabulated by Karatzas Marine Advisors & Co. (as per table herebelow), there are presently 34 ‘MR sized’ Jones Act tankers, two of which are shuttle tankers and four are US-flagged only; 30 of these tankers may be considered ‘modern’ with an average age of the fleet of less than seven years.

No doubt that the economics of the Jones Act tanker market seem fabulous at present (US$ 100,000 pd gross freight revenue, less approximately US$ 22,000 pd vessel operating expenses, on US$ 120 million cost basis but with overall cost of capital well into single-digit territory and long asset economic life); but 50% outstanding orderbook of the existing fleet doesn’t seem like moving into ‘dangerous’ (oversupplied) territory? After all, we all in shipping know what happened when the orderbook for foreign-flag vessels reached historically high levels… unless of course it turns out that we are experiencing an once-in-a-lifetime ‘game changer’ event with the discovery of shale oil, that political risk is low (of allowing crude oil to be exported overseas) and the Jones Act tankers market turns out to be fully insulated from international shipping economics.

© 2013 Basil M Karatzas All right reserved

No part of this blog can be reproduced, in whole or in part, without the prior written consent of the copyright holder. Please contact: info@bmkaratzas.com

Interesting Poten report a week ago postulating (smoking something?) that tankers from Alaska trades would find their way into coastal Jones Act like crude or maybe products out of Eagle Ford (Corpus – Houston) into US Gulf and US East coast destinations. Crazy? Maybe not.

Date Hello, I have browsed most of your posts. This post is probably where I got the most useful information for my research. Thanks for posting, maybe we can see more on this. Are you aware of any other websites on this subject